How to use your credit card while backpacking: 10 great tips

Using a credit card while backpacking can be convenient and safe. Here are some tips on how to use your credit card effectively:

Table of Contents

1. Notify your bank while backpacking:

Before you embark on your backpacking trip, inform your bank about your travel plans. This will help prevent any unexpected card blocks due to suspicious activity. Let them know the countries you’ll be visiting and the duration of your trip.

2. Choose a reliable credit card:

Opt for a credit card that offers travel-friendly features such as no foreign transaction fees and a reliable fraud protection system. Additionally, ensure that your credit card is widely accepted in the countries you’ll be visiting.

3. Keep backup cards:

It’s always a good idea to carry backup credit cards in case of loss, theft, or any unforeseen circumstances. Keep your backup cards separate from your primary card to avoid losing all your access to funds.

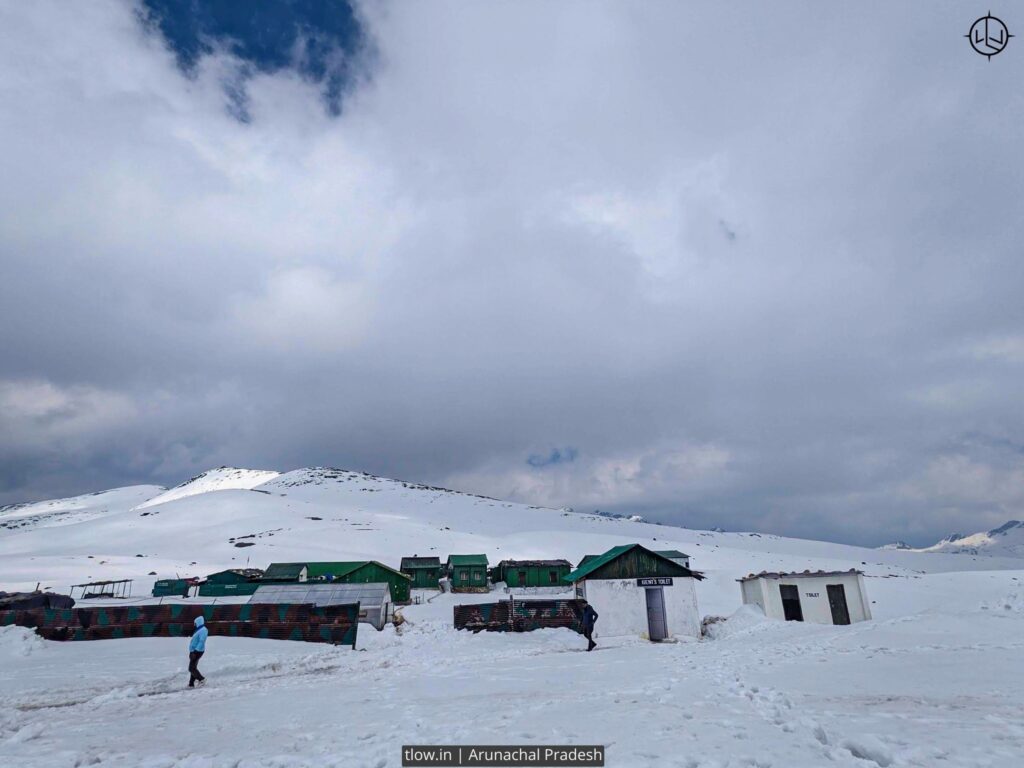

For the TLOW backpacking experience click on this link

4. Use ATMs wisely:

ATMs are usually the best way to withdraw cash abroad. Look for ATMs in well-lit and secure areas, preferably inside banks or reputable establishments. Be cautious of skimming devices and cover the keypad when entering your PIN. Also, keep in mind any fees your bank may charge for international ATM withdrawals.

5. Monitor your spending:

Keep track of your credit card transactions regularly, either through your online banking portal or mobile app. This way, you can detect any unauthorized charges promptly and report them to your bank.

6. Save receipts:

Whenever you make a purchase, save your receipts. They can be useful for verifying charges, tracking expenses, and resolving any disputes that may arise.

7. Beware of exchange rates:

If you’re given the option to pay in your home currency or the local currency, choose the local currency. This way, you’ll avoid unfavorable exchange rates and any additional fees that may be charged.

8. Keep emergency contact information:

Take note of your credit card’s emergency contact number or save it in your phone. In case of loss, theft, or any issues, you can quickly reach out to your credit card provider for assistance.

9. Use secure connections for online transactions:

When making online purchases or accessing your credit card account, use secure and trusted internet connections. Avoid using public Wi-Fi networks that may compromise the security of your personal information.

10. Set a budget:

Before your trip, establish a realistic budget and stick to it. Proper budgeting will help you manage your expenses and ensure you don’t overspend on your credit card.

Remember, while credit cards can be convenient, it’s essential to use them responsibly and be mindful of your spending.